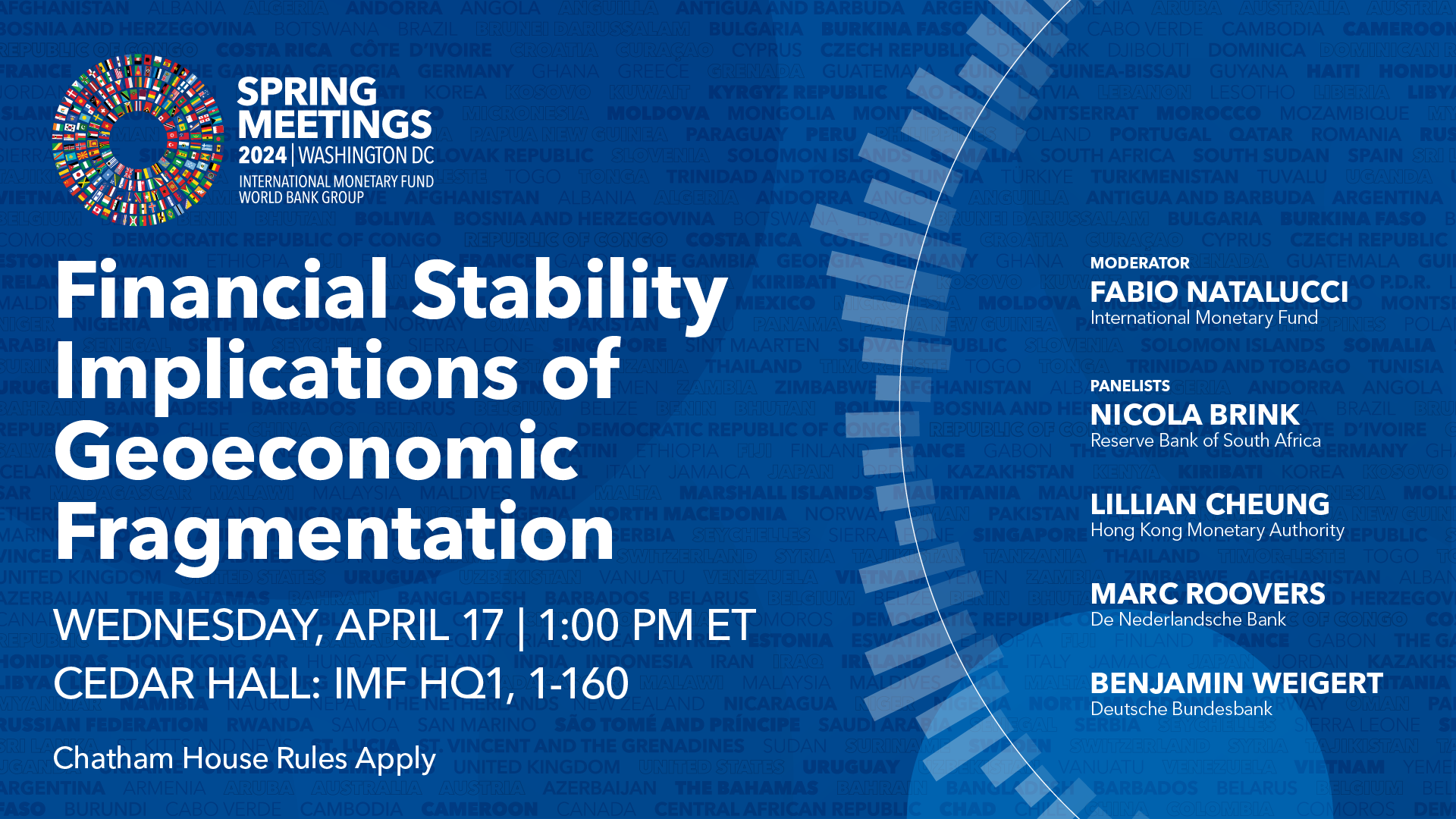

Wednesday, Apr 17, 2024 | 01:00 PM - 02:00 PM

Location: Cedar Hall, HQ1-1-660

OVERVIEW

Geopolitical tensions among several major economies have risen in the past few years, raising concerns of a reversal of global economic and financial integration—or “geoeconomic fragmentation.” Geoeconomic fragmentation could have potentially important implications for global financial stability by affecting the cross-border allocation of capital, international payment systems and asset prices, and by undermining economic growth and generating inflationary pressures. Moreover, geoeconomic fragmentation could exacerbate macro-financial volatility in the longer term and raise the likelihood of crises by amplifying the impact of adverse shocks through a reduction in international risk diversification opportunities. Against this backdrop, this panel discussion would bring together representatives from central banks across different regions to exchange views on the challenges posed by geoeconomic fragmentation for maintaining financial stability, and how to identify and manage the risks.

This will be an in-person event held under Chatham House Rules.

SPEAKERS

Moderator: Fabio Natalucci, IMF