The Global Markets Monitor is a daily IMF report covering major global financial and economic developments.

The report is issued around 9 AM US Eastern Time, Monday to Friday.

Click here to subscribe.

- Higher energy prices challenge markets as Middle East war continues

- Euro area and Asia particularly vulnerable due to heavy reliance on energy imports

- HALO trade drives equity markets

- Credit investors flag AI issues as biggest risk to market

- US equities remain close to record high despite Mag 7 slump

- Higher inflation could slow rate cuts in Brazil

Global markets grapple with war in the Middle East

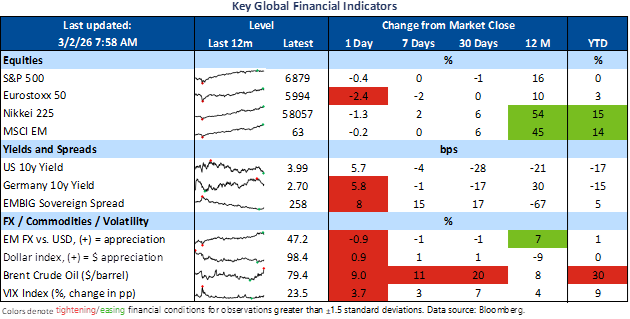

Most markets across the globe were in the red as the war in the Middle East continued. Oil prices are up almost 10% intra-day, with Brent crude trading close to $80, the highest level since the previous attack on Iran in June. The dollar is stronger on safe haven buying. Natural gas prices are also up very sharply. Government bond yields in the US and Europe are higher due to worries about inflation caused by the rise in energy prices. Tanker traffic through the Strait of Hormuz appears to have come to a halt, increasing the risk that the spike in oil and natural gas prices could push up global inflation. About 20% of global oil production normally flows the Strait. The euro area and much of Asia are seen as particuarly vulnerable to higher energy prices due to their heavy reliance on energy imports. However, the overall market impact outside the energy sector has been relatively limited, perhaps because other recent geopolitical risk events have not had a lasting effect on markets.