Thursday, Oct 12, 2023 | 01:30 PM - 02:00 PM

Location: AB02 Irhoud

REPORT

Blurb:

How has the impact of global shocks been tackled effectively in India? What has been India’s experience with digitalization, in particular, with pioneering the central bank digital currency and how has it helped to improve financial inclusion, innovation and efficiency?

Key Points:

Managing successive shocks: Over the past five years, India witnessed a series of shocks, including the failure of a large non-bank lender in 2018, followed by the pandemic shock, and the war in Ukraine, which aggravated the financial stress and brought up inflationary pressures. The central bank responded in a bold and proactive manner, by providing relief to markets and identifying potential areas of risks. Active coordination between fiscal and monetary authorities ensured a well-calibrated and targeted response. There was no excessive fiscal expansion relative to advanced economies and at the same time, strong support was provided to the financial markets for better liquidity management.

Quotes:

“Active coordination between the fiscal and monetary authorities have helped us. And I think this is something which I would like to emphasize, not just when we are facing a crisis. Even in normal times, there is need for constant engagement and coordination between fiscal and monetary authorities, because these agencies are ultimately working for the economy.” Shaktikanta Das

“CBDC is going to be the future currency of the world and it is necessary that every central bank, every country works on CBDC.” Shaktikanta Das

Contributor: Zahir Sakhi

PHOTOS

OVERVIEW

Frontiers of Central Banking In Asia

A conversation between IMF’s Director of Asia and Pacific Department Krishna Srinivasan and Governor of Reserve Bank of India Shaktikanta Das

IMF’s Director of Asia-Pacific Department Krishna Srinivasan and RBI Governor Shaktikanta Das will discuss the frontier issues of central banking in the context of the post-pandemic recovery. The recent global inflationary episodes have posed significant challenges for central banks, as they balance the trade-offs between price stability, growth, and financial stability. Moreover, central banks are also facing new and emerging issues, such as central bank digital currency (CBDC), digital payment infrastructure, and the climate transition. These issues have implications for monetary policy, financial inclusion, financial innovation, and green transition. This conversation will explore how central banks can address these issues effectively and efficiently, drawing on the experience and insights of Governor Das, who has led the RBI in successfully bring down inflation post-pandemic, introducing CBDC, developing digital payment infrastructure, and promoting green finance in India.

SPEAKER

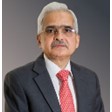

Shaktikanta Das

Governor of the Reserve Bank of India

Shri Shaktikanta Das, Governor of Reserve Bank of India, has been a career civil servant with over 42 years of distinguished service, primarily in the areas of finance, taxation, investment and infrastructure.

Shri Das possesses a unique combination of experience in both policy formulation and implementation at the highest levels of state and central governments. He has served as Revenue Secretary and as Secretary, Economic Affairs, Government of India. In these positions, he played important roles in conceptualisation and formulation of key policies in the areas of economic reforms, fiscal and monetary policy, financial markets and investment policy. He also served as a Director in the Central Board of RBI rendering advice in the areas of Central Banking. He was also on the Board of Securities and Exchange Board of India (SEBI), the regulator for capital markets.

Shri Das has served as India’s Alternate Governor in the World Bank, Asian Development Bank (ADB), New Development Bank (NDB) and Asian Infrastructure Investment Bank (AIIB). He represented India in several international fora like the IMF, G20, BRICS and SAARC.

Shri Das has also acted as India’s G20 Sherpa and Member, Fifteenth Finance Commission.

As Governor, Reserve Bank of India, he has spearheaded a series of measures taken by the Reserve Bank to support growth and strengthen financial stability in the country. Since the onset of COVID-19 pandemic, he has steered the Reserve Bank’s response through several conventional, unconventional and innovative policy measures spanning monetary policy, liquidity conditions and regulatory policies to preserve financial stability while mitigating the adverse effects of the pandemic on the economy.

Shri Das was recently conferred with the Central Bank ‘Governor of the Year’ award by Central Banking Publication, UK in 2023. He was rated ‘A+’ by Global Finance Magazine in their Central Bank Report Card 2023. He was also conferred the 'Central Banker of the Year, Asia-Pacific 2020' award by the London based magazine-The Banker.

MODERATOR

Krishna Srinivasan

Director of the Asia and Pacific Department, IMF

Krishna Srinivasan is the Director of the Asia and Pacific Department (APD). In this capacity, he will oversee the institution’s work on all countries in the Asia-Pacific region. He was previously a Deputy Director in APD, overseeing the work on several systemically important countries, including China and Korea. Prior to that, Krishna was a Deputy Director in the Western Hemisphere Department (WHD), where he oversaw the institution’s work on several countries in the Americas, including Brazil, Canada, Mexico, Peru, Ecuador and the island economies of the Caribbean, the department’s research activities, and its flagship product, Regional Economic Outlook (REO) for Latin America and the Caribbean. He is a co-editor of two recent books: Brazil—Boom, Bust and the Road to Recovery; and Unleashing Growth and Strengthening Resilience in the Caribbean. Before joining WHD, Krishna was the IMF’s mission chief for the United Kingdom and Israel, when he was a staff member of the European Department, and before that in the Research Department, where he led the IMF’s work on the G-20 in the context of the global financial crisis. In the context of this work, he and was the editor of an IMF book Global Rebalancing: A Roadmap for Economic Recovery. Krishna has been with the IMF since 1994 and has served in several departments across the institution. He secured his PhD in International Finance from Indiana University and a Master’s from the Delhi School of Economics, India, and has published several papers both at the IMF and in leading academic journals.